Table of Contents

- Why Refinance Your Car Loan?

- When to Consider Refinancing

- Eligibility Criteria

- Steps to Refinance Your Car Loan

- Potential Savings from Refinancing

- Common Pitfalls to Avoid

- Final Thoughts

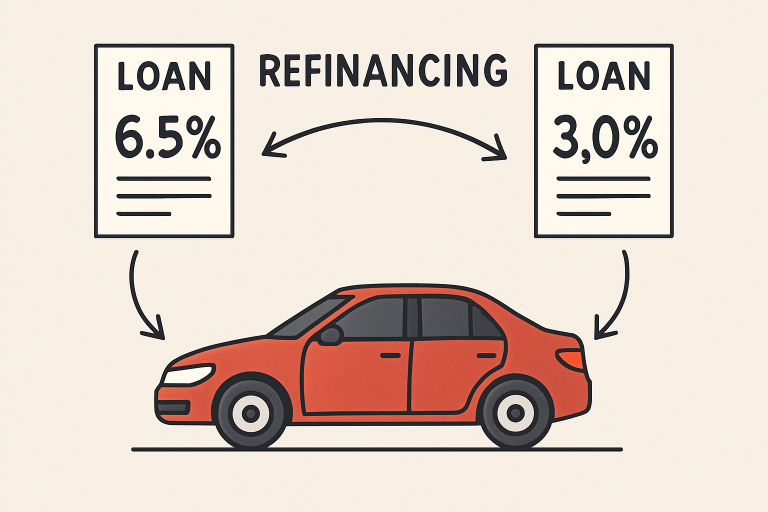

Refinancing your car loan is a powerful way to reduce your monthly payments and overall interest expenses. Through the process of replacing your existing loan with a new one, you may be able to secure a lower rate, shorten the term, or simply make your monthly budget more manageable. For anyone wondering whether refinancing is the right move, this detailed guide explains what you need to know. If you are ready to start, resources like iLending can help you compare your options and find a solution that fits your financial situation.

Understanding all the steps involved is key to maximizing savings and minimizing pitfalls. Timing, eligibility factors, and knowledge of potential fees all matter. Refinancing can lead to significant cost reductions, but it is important to weigh the pros and cons for your unique circumstances.

Whether your credit score has improved, current market interest rates have dropped, or your financial situation has shifted, refinancing can open the door to more favorable loan terms. Before moving forward, evaluate your current loan, compare offers from different lenders, and calculate your potential savings.

Why Refinance Your Car Loan?

Refinancing means taking out a new loan to pay off your existing auto loan, ideally under better terms. The most common reasons people refinance car loans are:

- Lower Interest Rates: If you qualify for a lower rate than your original loan, you can reduce the total amount of interest you pay over the life of the loan.

- Reduced Monthly Payments: With either a lower rate or a longer repayment period, your monthly payments can become more manageable, freeing up cash flow for other needs.

- Shorter Loan Term: By shortening the loan term, you can pay off the vehicle sooner and save on long-term interest costs.

When to Consider Refinancing

There are certain situations when refinancing offers the most benefit:

- Improved Credit Score: If your credit has improved since you took out your original loan, you may now qualify for much better rates.

- Favorable Market Rates: Auto loan rates fluctuate, so a drop in rates could mean big savings if you refinance when the timing is right.

- Financial Changes: If your income has changed or you need to adjust your cash flow, refinancing can help make your monthly budget more manageable.

Eligibility Criteria

Not everyone or every loan qualifies for refinancing. Lenders will consider several eligibility factors:

- Vehicle Age and Mileage: Most lenders have restrictions on the age and mileage of your car. Typically, vehicles older than 10 years or with more than 100,000 miles may not qualify.

- Loan-to-Value Ratio (LTV): Lenders generally require that your loan amount not exceed a certain percentage of the car’s value, often around 125 percent.

- Payment History: A consistent record of on-time payments strengthens your application and proves you’re a reliable borrower.

Steps to Refinance Your Car Loan

- Assess Your Current Loan: Review your current interest rate, remaining balance, and repayment terms to determine if refinancing will be beneficial.

- Check Your Credit Score: Get a copy of your credit report, as your score impacts your ability to secure better terms.

- Research Lenders: Compare offers from banks, credit unions, and online lenders to find the most competitive rates and terms.

- Calculate Potential Savings: Use online calculators to estimate how much you could save on monthly payments and interest costs.

- Gather Necessary Documents: Collect documents such as proof of income, vehicle information, proof of insurance, and your current loan payoff statement.

- Apply for Refinancing: Submit applications to the lenders you selected and review all terms before choosing the best offer.

- Finalize the New Loan: Once approved, complete any required paperwork to close on your new loan and pay off your original lender.

Potential Savings from Refinancing

Refinancing can generate significant savings. For example, borrowers who refinanced their auto loans in 2025 reduced their monthly payments by an average of $142, resulting in about $1,346 in total savings on loan costs. For more insights, visit this LendingTree study that breaks down the financial impact of refinancing in the current market.

Common Pitfalls to Avoid

While refinancing offers many benefits, there are important pitfalls to be aware of:

- Prepayment Penalties: Some auto loans include fees for early payoff. Confirm your current loan’s terms before committing to a new one.

- Extending Loan Terms Unnecessarily: Lower payments can be tempting, but extending your loan term often leads to paying more interest over time.

- Hidden Fees: Before agreeing to the new terms, review the paperwork thoroughly to spot any administrative or loan origination fees.

Final Thoughts

Refinancing your car loan can be a practical way to meet your financial objectives. By staying informed on the process, comparing lender offers, and being aware of hidden costs or penalties, you put yourself in the best position to benefit. Take time to review your financial goals and carefully consider your options to ensure refinancing helps you achieve real savings and a healthier financial future.